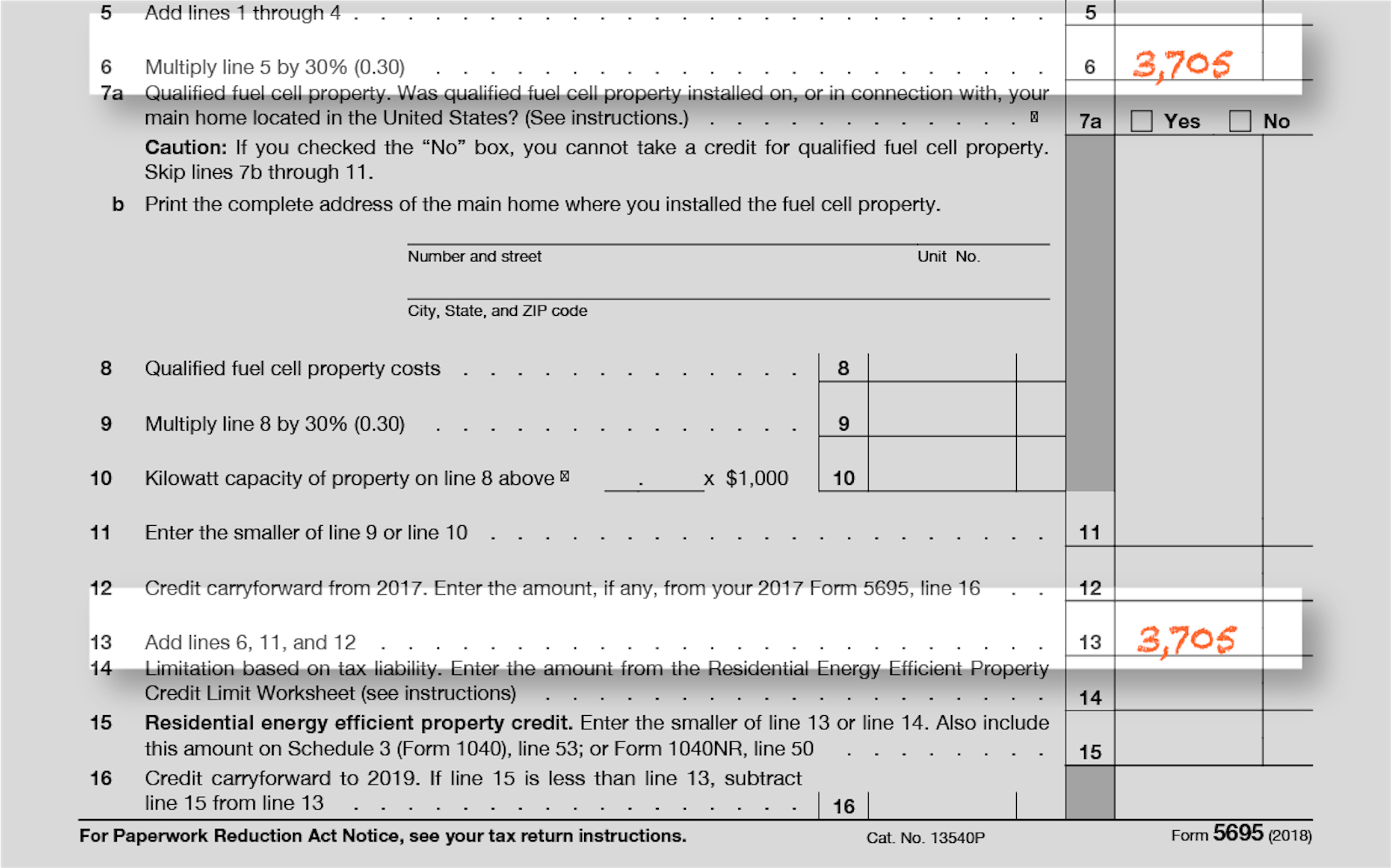

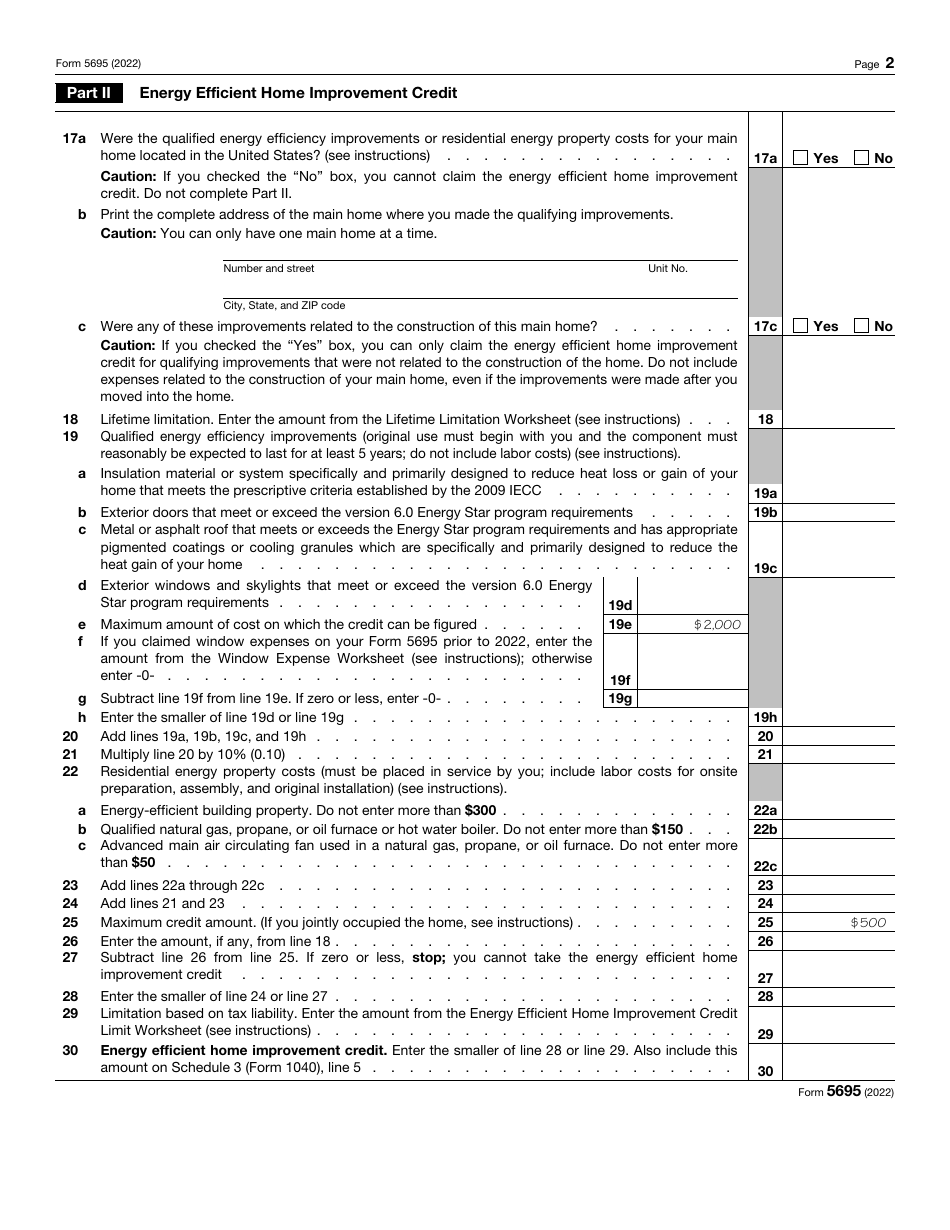

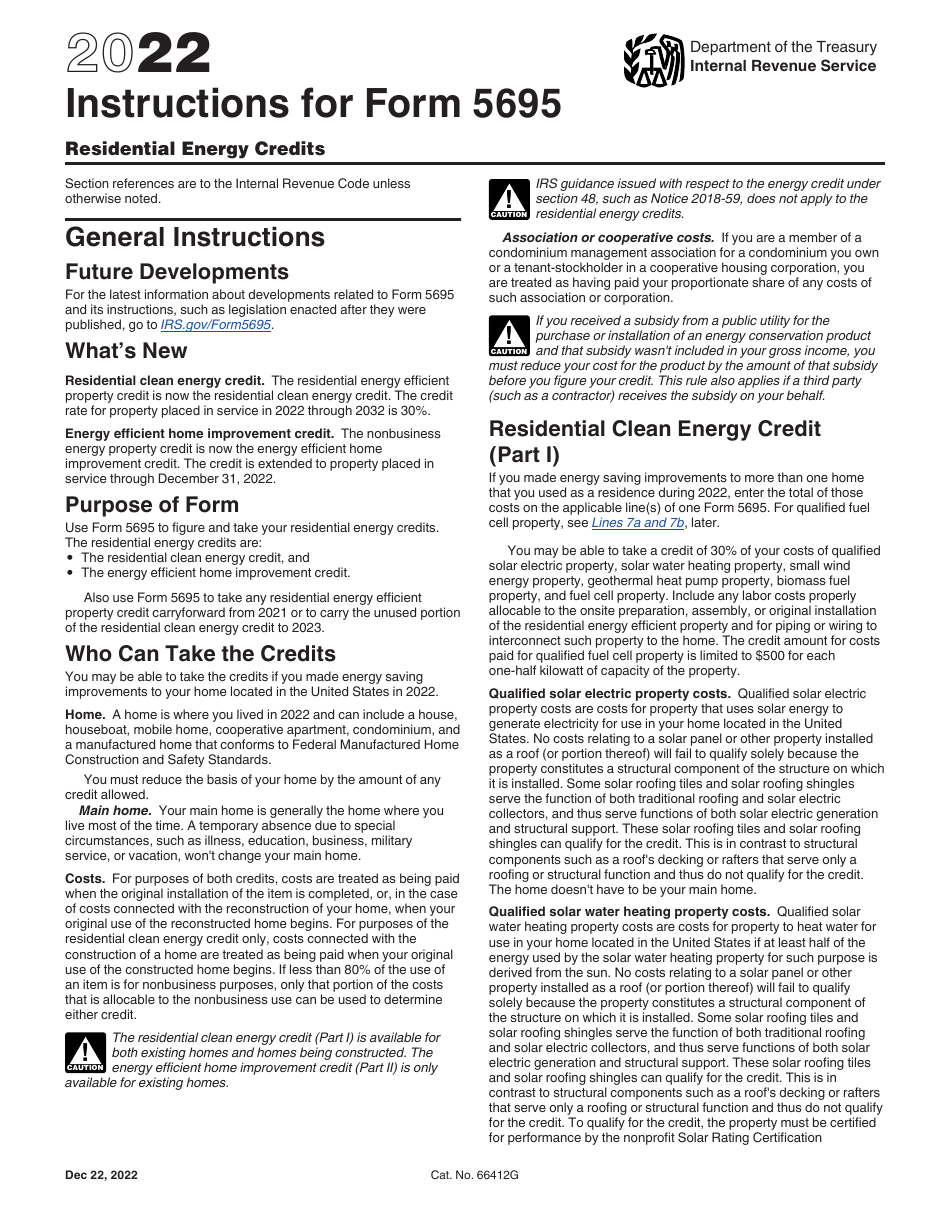

Irs Form 5695 Instructions 2025 Pdf - IRS Form 5695 Instructions Residential Energy Credits, Fuel cell property is subject to a maximum credit of $500 for every. File form 5695, residential energy credits with your tax return for the year in which the property is installed. IRS Form 5695 Instructions Residential Energy Credits, File form 5695, residential energy credits with your tax return for the year in which the property is installed. Fuel cell property is subject to a maximum credit of $500 for every.

IRS Form 5695 Instructions Residential Energy Credits, Fuel cell property is subject to a maximum credit of $500 for every. File form 5695, residential energy credits with your tax return for the year in which the property is installed.

IRS Form 5695 Instructions Residential Energy Credits, Fuel cell property is subject to a maximum credit of $500 for every. File form 5695, residential energy credits with your tax return for the year in which the property is installed.

File form 5695, residential energy credits with your tax return for the year in which the property is installed. Fuel cell property is subject to a maximum credit of $500 for every.

File form 5695, residential energy credits with your tax return for the year in which the property is installed.

IRS Form 5695 Instructions Residential Energy Credits, Fuel cell property is subject to a maximum credit of $500 for every. File form 5695, residential energy credits with your tax return for the year in which the property is installed.

IRS Form 5695 Instructions Residential Energy Credits, File form 5695, residential energy credits with your tax return for the year in which the property is installed. Fuel cell property is subject to a maximum credit of $500 for every.

Form 5695 2025 2025 IRS Forms TaxUni, Fuel cell property is subject to a maximum credit of $500 for every. File form 5695, residential energy credits with your tax return for the year in which the property is installed.

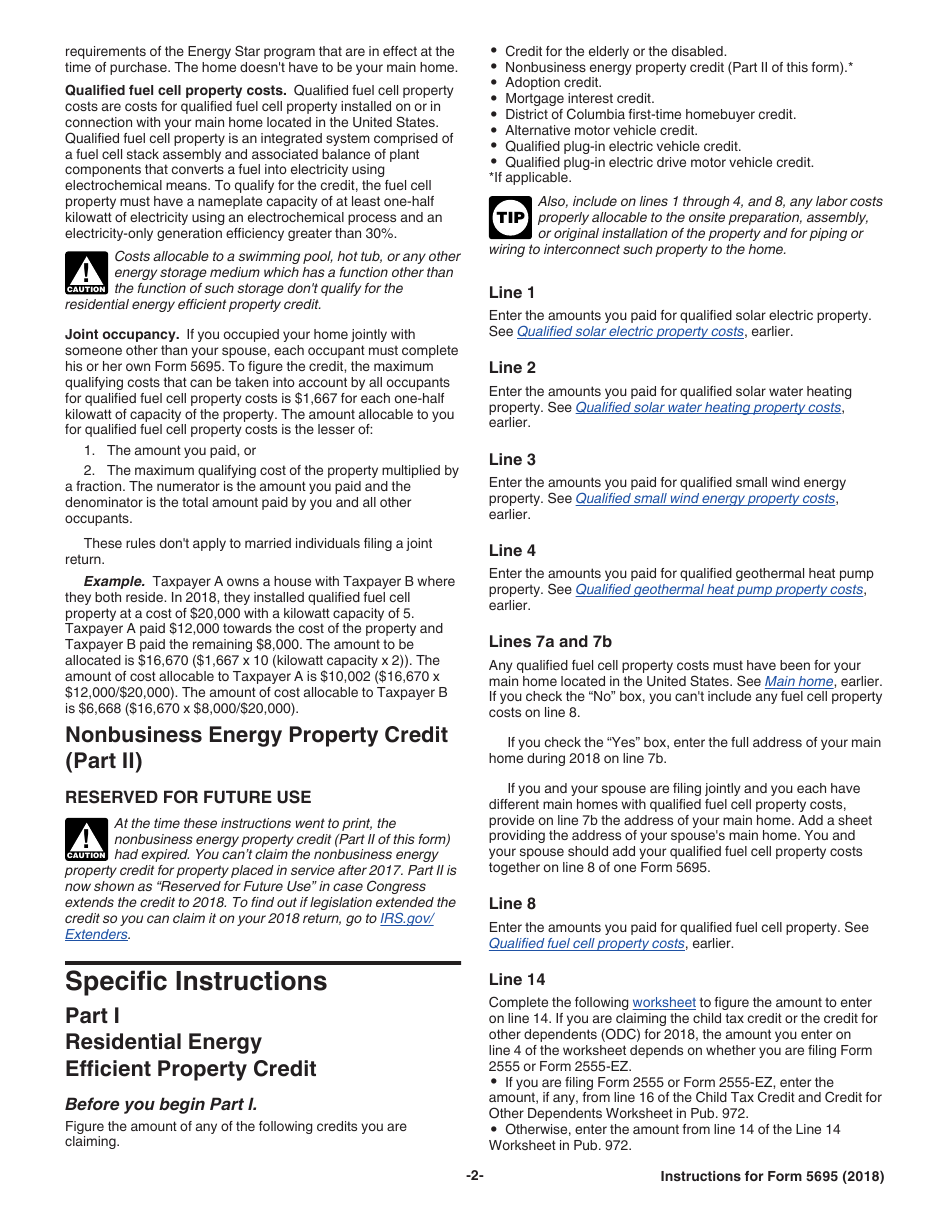

Download Instructions for IRS Form 5695 Residential Energy Credit PDF, Fuel cell property is subject to a maximum credit of $500 for every. File form 5695, residential energy credits with your tax return for the year in which the property is installed.

Download Instructions for IRS Form 5695 Residential Energy Credits PDF, Fuel cell property is subject to a maximum credit of $500 for every. File form 5695, residential energy credits with your tax return for the year in which the property is installed.

IRS Form 5695 Download Fillable PDF or Fill Online Residential Energy, File form 5695, residential energy credits with your tax return for the year in which the property is installed. Fuel cell property is subject to a maximum credit of $500 for every.

Irs Form 5695 Instructions 2025 Pdf. File form 5695, residential energy credits with your tax return for the year in which the property is installed. Fuel cell property is subject to a maximum credit of $500 for every.